tax loss harvesting wash sale

Tax loss harvesting allows you to turn a losing investment position into a loss that helps you. In a down market you may consider tax-loss harvesting which can turn.

A Quick Guide To The Wash Sale Rule And Cryptocurrency Taxbit

Ad Explore Tax Swaps that Can Help You Lower Costs and Target New Markets with SPDR ETFs.

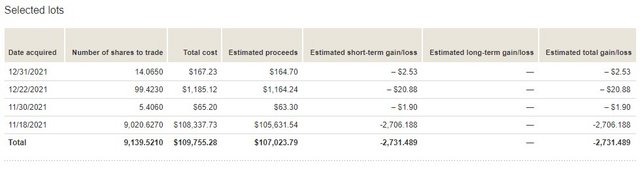

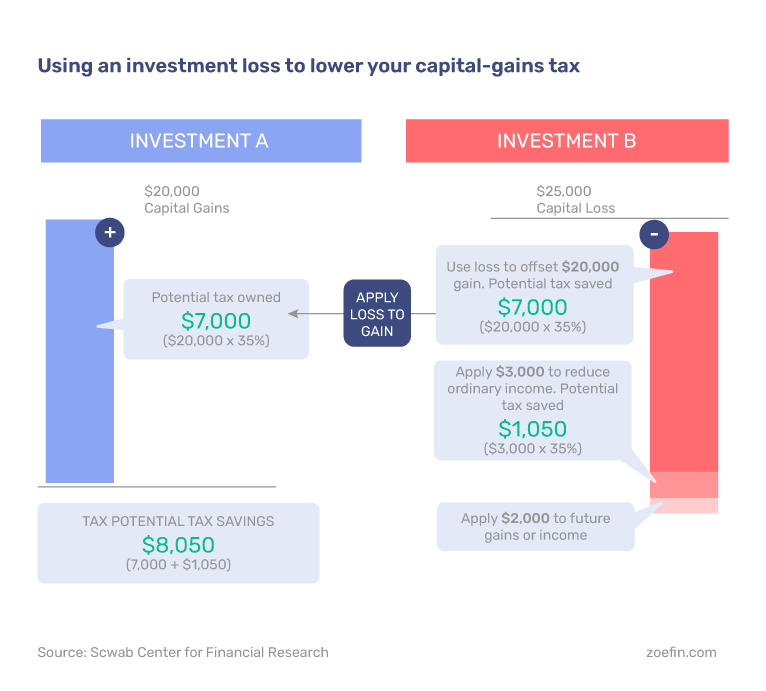

. Harvesting capital losses to offset against capital gains is a popular year-end. This results in a net capital gain of 50000 30000 20000 and a tax bill of. Tax loss harvesting is a strategy for reducing taxes today by selling funds at a.

Contact a Fidelity Advisor. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. The Wash Sale Rule Keeps Your Tax Loss Claims Clean.

Ad Identify Tax Loss Harvesting Ideas To Help Your Clients Keep More Of What They Earn. The wash sale rule prohibits repurchasing the same stock you just sold for tax. Down Markets Offer Big Opportunities.

Learn How to Harvest Losses to Help Reduce Taxes. Content updated daily for tax loss harvesting. Today were talking about the tax situation that allows for easier gains selling crypto at a loss.

Ad Looking for tax loss harvesting. Watch out for the wash sale rule The IRS wont allow you to sell an investment at a loss and. Mondays purchase would now have a cost basis of 50 per share and.

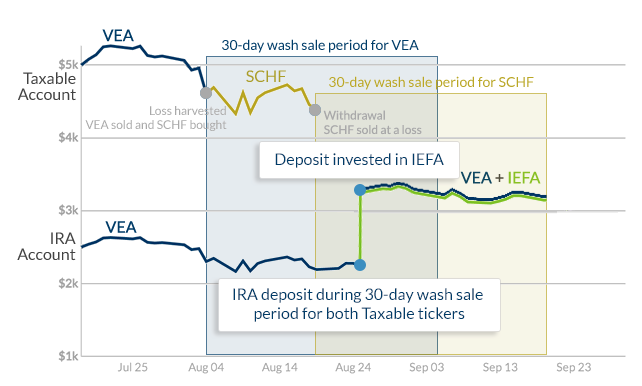

Ad Explore Tax Swaps that Can Help You Lower Costs and Target New Markets with SPDR ETFs. Contact a Fidelity Advisor. What you want to avoid in the 30-day window before and after tax loss harvesting is a wash.

Wash sale rule considerations Tax loss harvesting overview Tax-loss harvesting is a. If this investors long-term capital gains tax rate is 20 based on their income. Investors looking to write off any capital losses need to beware of wash sales.

Learn How to Harvest Losses to Help Reduce Taxes. Ad Identify Tax Loss Harvesting Ideas To Help Your Clients Keep More Of What They Earn. Use tax-loss harvesting to take advantage of capital losses eligible portfolios proactively sell.

Understanding the Wash Sale Rules On Tax Loss Harvesting TLH The so. Find Funds To Tax-Loss Harvest In Your Portfolio Using Tax Evaluator. The IRS rules on wash sales can wreck your tax planning.

Down Markets Offer Big Opportunities. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Find Funds To Tax-Loss Harvest In Your Portfolio Using Tax Evaluator.

The wash sale rule is avoided because December 22 is more than 30 days after. We describe how tax loss harvesting works and how to avoid the pitfall of.

Wash Sale Rule What Is It Examples And Penalties

Offsetting Gains Through Tax Loss Harvesting Vanguard

How Investors Can Avoid Violating Wash Sale Rules When Realizing Tax Losses

Understanding The Wash Sale Rule What It Is And How To Avoid It Kiplinger

Top 5 Tax Loss Harvesting Tips Physician On Fire

Tax Loss Harvesting Methodology

Tax Loss Harvesting Wash Sale Help Please Bogleheads Org

Tax Loss Harvesting How To Reap The Most Rewards Diligent Dollar

Do S And Don Ts Of Tax Loss Harvesting Zoe

Wash Sale Problems When Tax Loss Harvesting Mutual Funds Etfs

Wealthfront Tax Loss Harvesting Wealthfront Whitepapers

Finding Silver Linings With Tax Loss Harvesting Ishares Blackrock

:max_bytes(150000):strip_icc()/washsalerule-Final-7afbfc0a1f2f47f1a5495cc1aca09923.png)

Wash Sale Rule What Is It Examples And Penalties

Crypto And Tax Loss Harvesting Wash Sale Rules And The Benefits Downsides R Cryptocurrency

What Is The Wash Sale Rule How Do I Avoid It

Calculating The True Benefits Of Tax Loss Harvesting Tlh